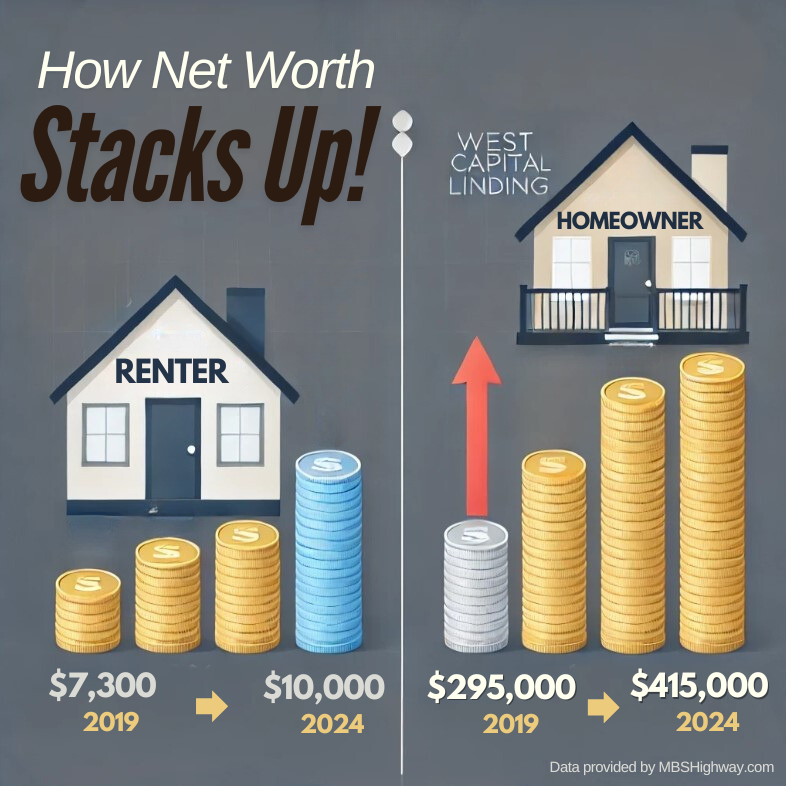

Even as inflation slows, many people still feel the strain of higher prices. Homeownership stands…

Prepare Yourself for Some Big Bond Updates

Weekly Market Update: Big News for Mortgage Rates

What’s Happening Next Week?

Some important economic reports are coming up:

- Tuesday: Productivity and Labor Costs

- Wednesday: Consumer Price Index and 10-Year Treasury Auction

- Thursday: Jobless Claims and 30-Year Bond Auction

Why does this matter? These reports affect mortgage bonds, which help determine mortgage rates. Right now, mortgage bonds are trending higher, which is good news—it might mean better rates are on the way.

Check Your Savings: Curious how these trends affect your mortgage rate? Use our mortgage calculator or schedule a quick call with me today.

Jobs Report: What It Means for You

The November jobs report showed 227,000 new jobs, which sounds great. But digging deeper:

- Many of these jobs were temporary or bounce-backs from earlier strikes.

- A separate survey showed job losses of 355,000, and unemployment ticked up to 4.2%.

- A broader measure of unemployment rose to 7.8%, showing more struggles in the labor market.

Why does this matter? The weak job market is helping mortgage bonds improve, which could mean better rates for you.

Check Your Savings: See how these changes might lower your monthly payments. Try our calculator or book a call with me today.

What Should You Do Now?

With the bond market moving in a positive direction and rates stabilizing, this is a great time to check your options. Don’t wait for rates to go back up!

Take Action: Use our mortgage calculator to see how much you could save, or schedule a call with me to lock in a great rate today.