Market Update: What’s Happening with the Fed, Retail Sales, and Mortgage Bonds Fed Outlook and…

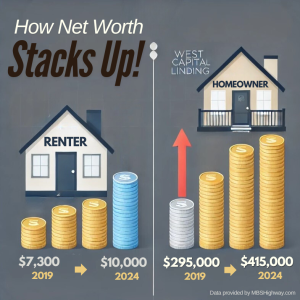

Homeownership is the Best Way to Beat Inflation

Here’s the proof:

-

-

- 2019: Homeowners had 40x the net worth of renters ($295,500 vs. $7,300).

-

- 2024: Homeowners now have 42x the net worth of renters ($415,000 vs. $10,000).

This incredible wealth gap shows how owning a home allows you to hedge against inflation and grow your net worth significantly over time.

Affordability Challenges and Buyer Demographics

Rising home prices and rates have made affordability more difficult, pushing the median age of first-time buyers to 38—up from 33 just three years ago. However, this also presents opportunities. Millennials born in the late 1980s and early 1990s are now entering peak home-buying years, creating sustained demand in the housing market.

Learn how homeownership can work for you: Schedule a call with me today, and let’s create a plan to secure your financial future through real estate.