🕒 How Long Do You Have to Wait to Refinance?

A Guide to Seasoning Periods & the Delayed Financing Exception

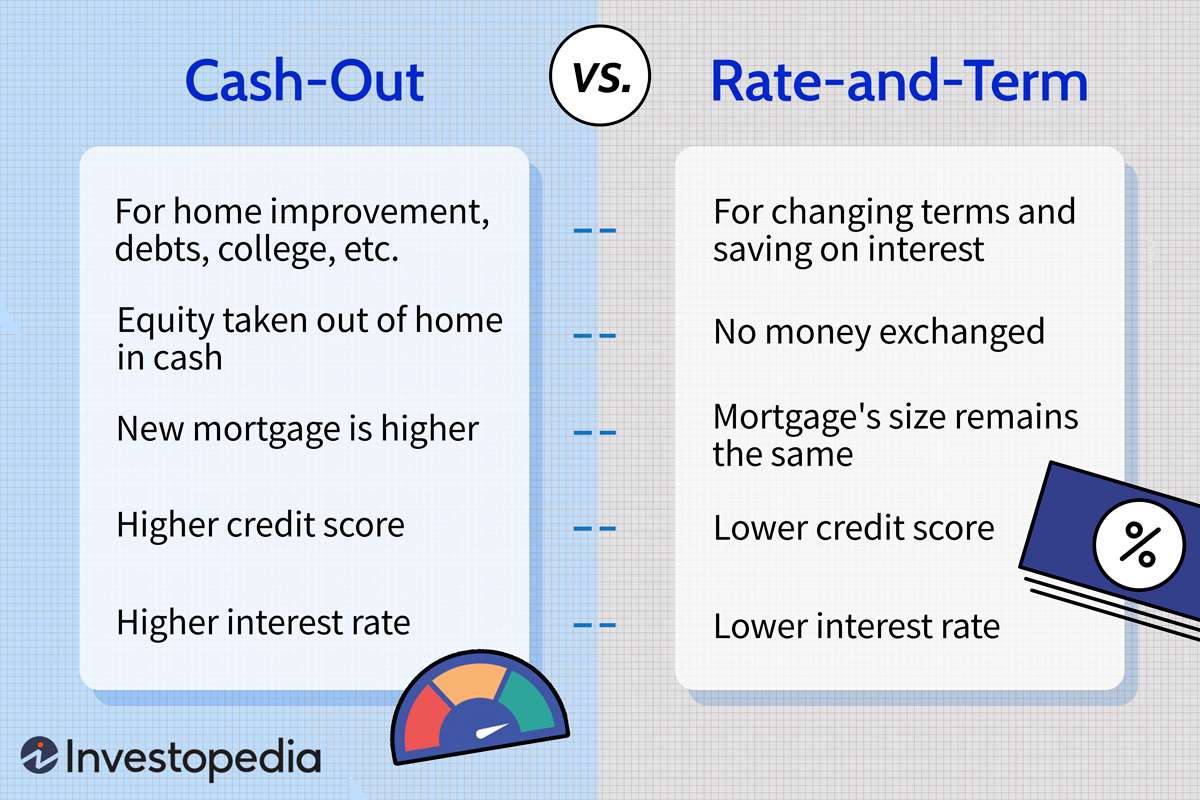

If you’re considering refinancing your home—whether it’s to lower your interest rate, pull out cash, or recoup money from a recent cash purchase—timing is everything. Mortgage lenders follow specific seasoning period rules that determine when you’re eligible.

Let’s break it all down in plain English 👇

🔁 Rate-and-Term Refinance (No Cash Out)

Refinancing just to lower your rate or change your loan term? Here’s what you need to know:

✅ Conventional Loans (Fannie Mae / Freddie Mac)

- No waiting period required

- Some lenders prefer 6 months of payment history for best pricing

🏠 FHA Loans

- Wait 210 days from your first payment due date

- Must make 6 on-time monthly payments

🇺🇸 VA IRRRL

- Wait 210 days from your first payment due date

- Must make 6 consecutive monthly payments

——————————————————————————————————–

💰 Cash-Out Refinance

Want to access your home’s equity as cash? Lenders have stricter rules:

✅ Conventional Loans

- You must be on title for at least 6 months

- Max loan based on appraised value

🏠 FHA Cash-Out

- Home must be your primary residence for 12 months

- You must be on title for 12 months

🇺🇸 VA Cash-Out

- Typically requires 6 months of ownership

———————————————————————————————————————

⚡ What Is the Delayed Financing Exception?

Bought your home with cash and want to refinance soon after?

You might qualify for a Delayed Financing Exception—a special rule that allows you to pull your money back out within 6 months of purchase.

🔒 Key Rules:

- Home was purchased with 100% cash

- Refinance must occur within 6 months

- You’re on the title

- You can prove the source of the purchase funds

- New loan amount can’t exceed the purchase price

📉 Which Home Value Is Used?

Even if your home appraises for more due to upgrades or market gains, the loan amount will be based on:

🟰 The lower of the purchase price or current appraised value

🚫 No credit for renovations… yet.

If you renovated and want to access that equity, you’ll need to wait 6 months and then apply for a standard cash-out refinance.

🧠 Example:

- Bought home for: $400,000 (cash)

- Appraised now: $450,000

- Max loan under Delayed Financing: $400,000

💡 Why Do Seasoning Rules Exist?

These guidelines are designed to:

- Prevent mortgage fraud and house flipping

- Ensure borrower stability and responsible lending

- Protect homeowners from early financial risks

✅ Final Thoughts

Timing matters when it comes to refinancing. Whether you’re trying to lower your rate or access your equity, understanding seasoning periods helps you plan smarter and avoid unnecessary delays.

📲 Ready to Explore Your Refinance Options?

I’ll walk you through the process step-by-step.

➡️ Book a free consultation and let’s find the right strategy for your situation.